If you’re considering getting married, you may be wondering what kind of financial affidavit you’ll need to file with the government. This document can help to set out your financial obligations should you get divorced or decide to separate. It can also help ensure that any children that you have are adequately provided for. In this article, we’ll explain everything you need to know about domestic relations financial affidavits.

What is a domestic relations financial affidavit?

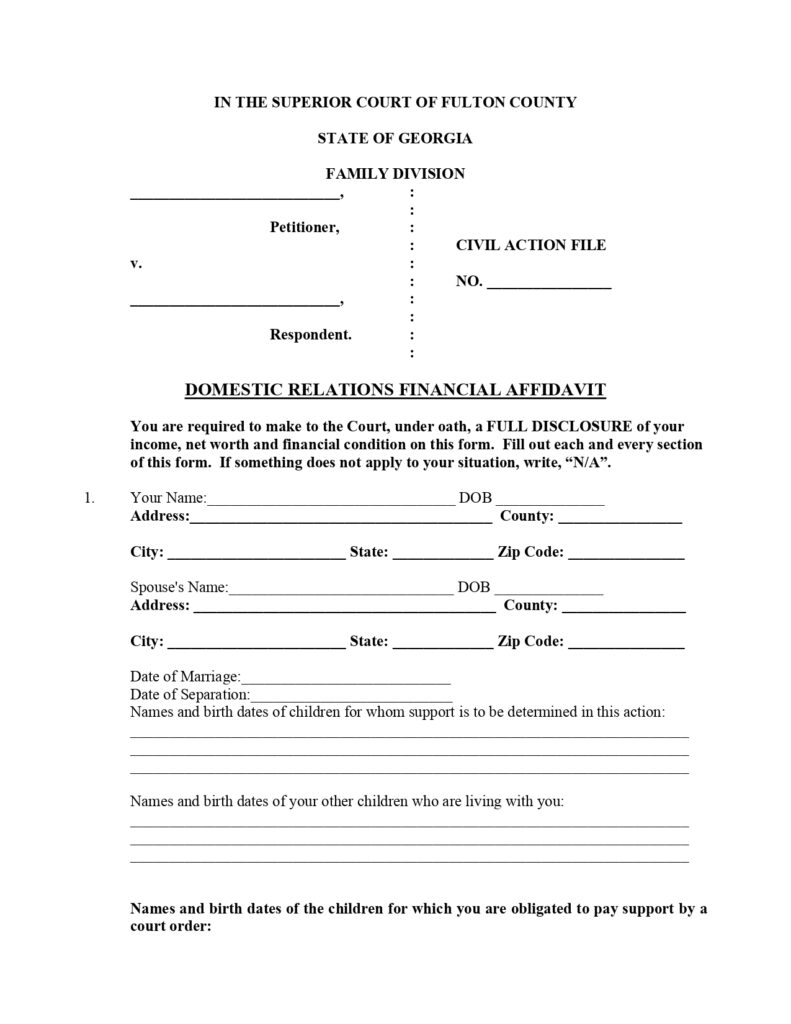

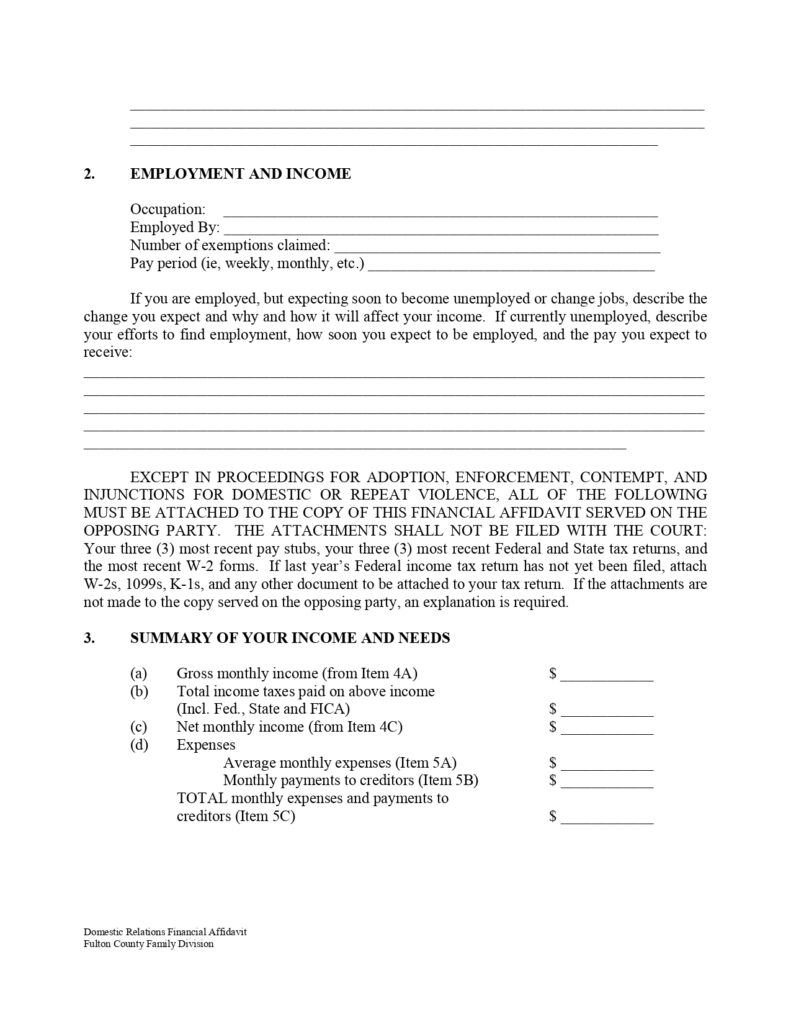

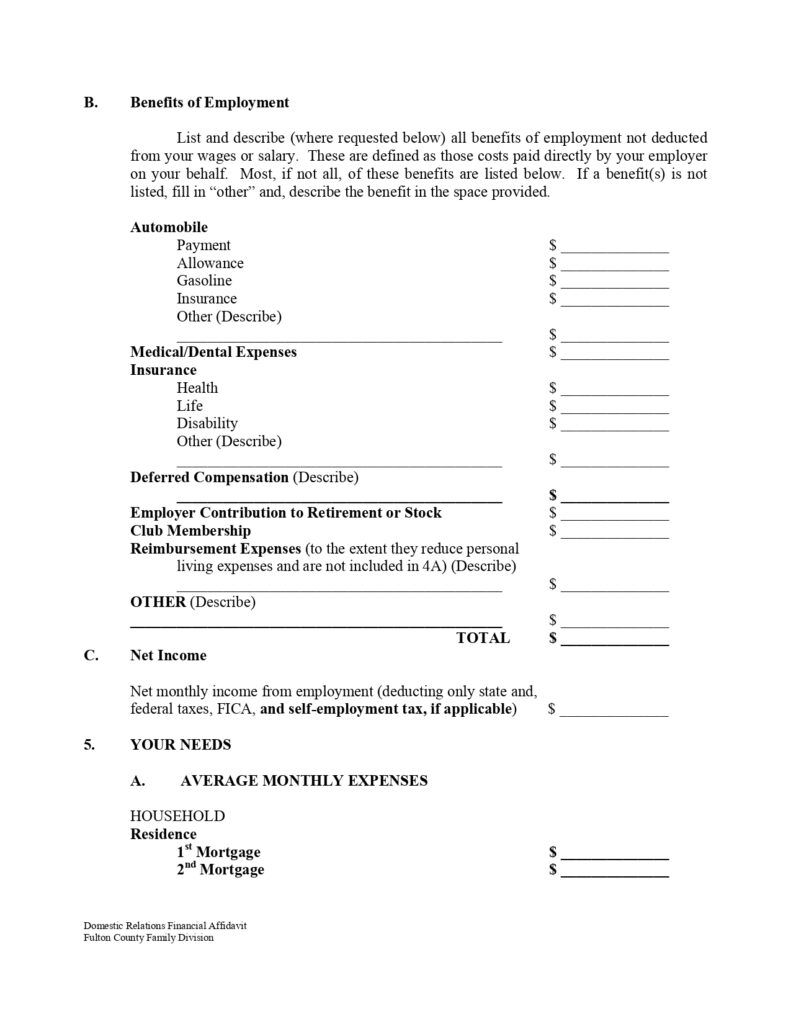

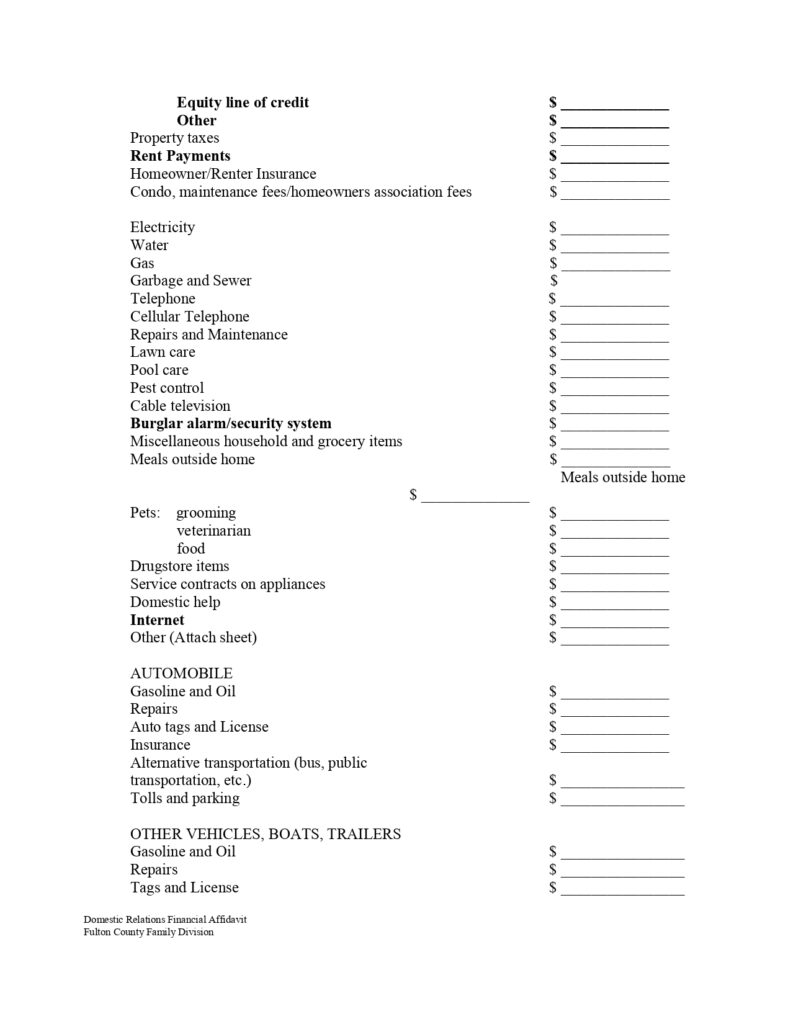

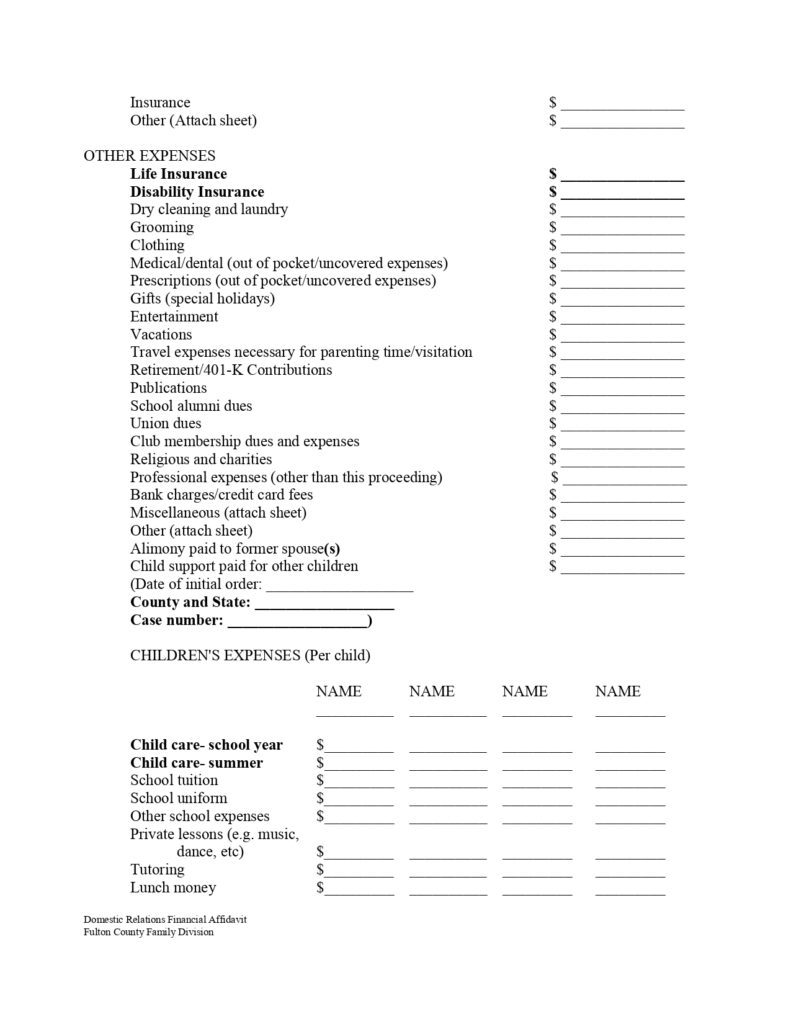

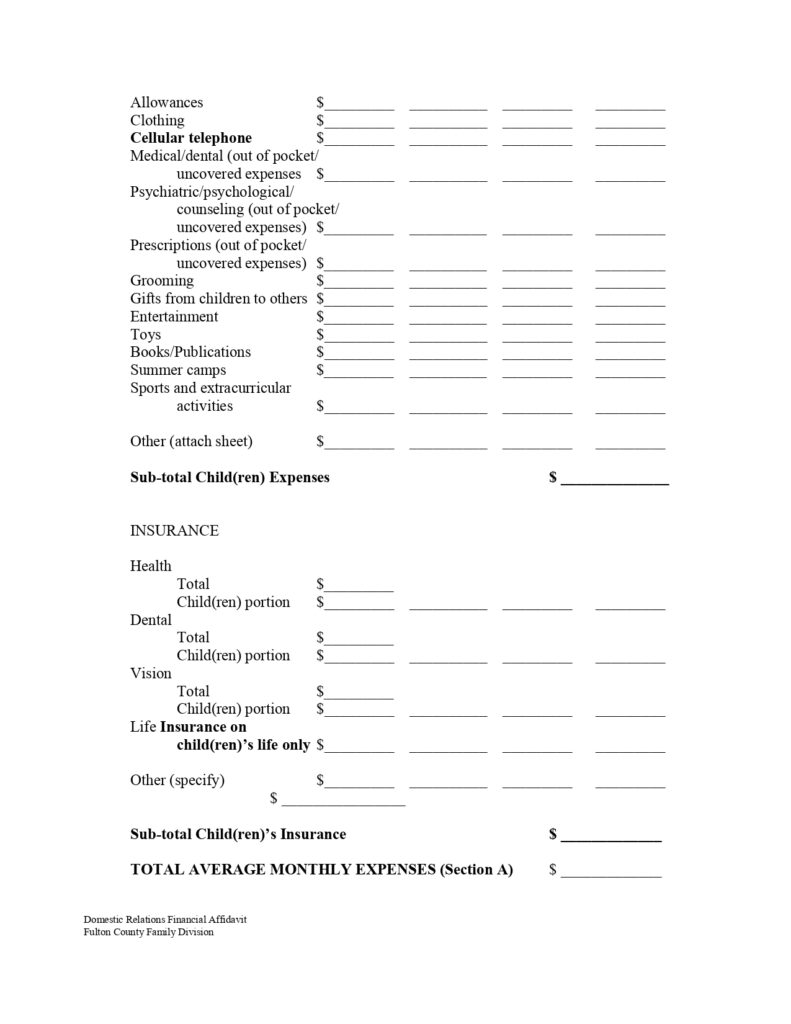

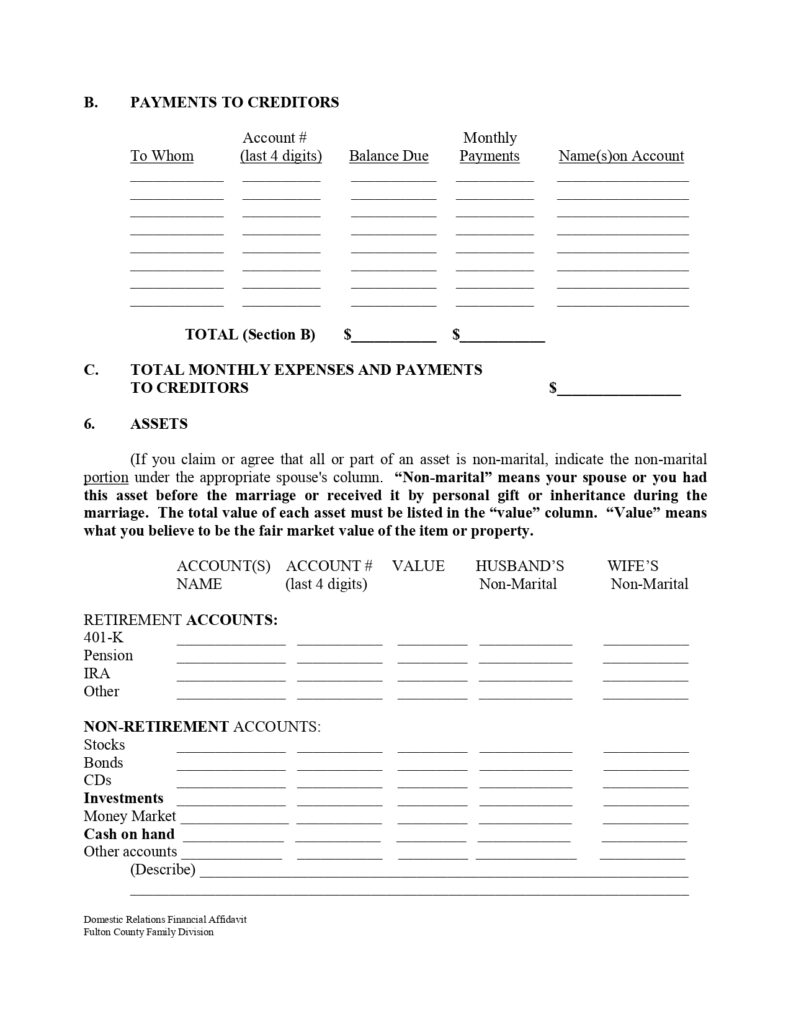

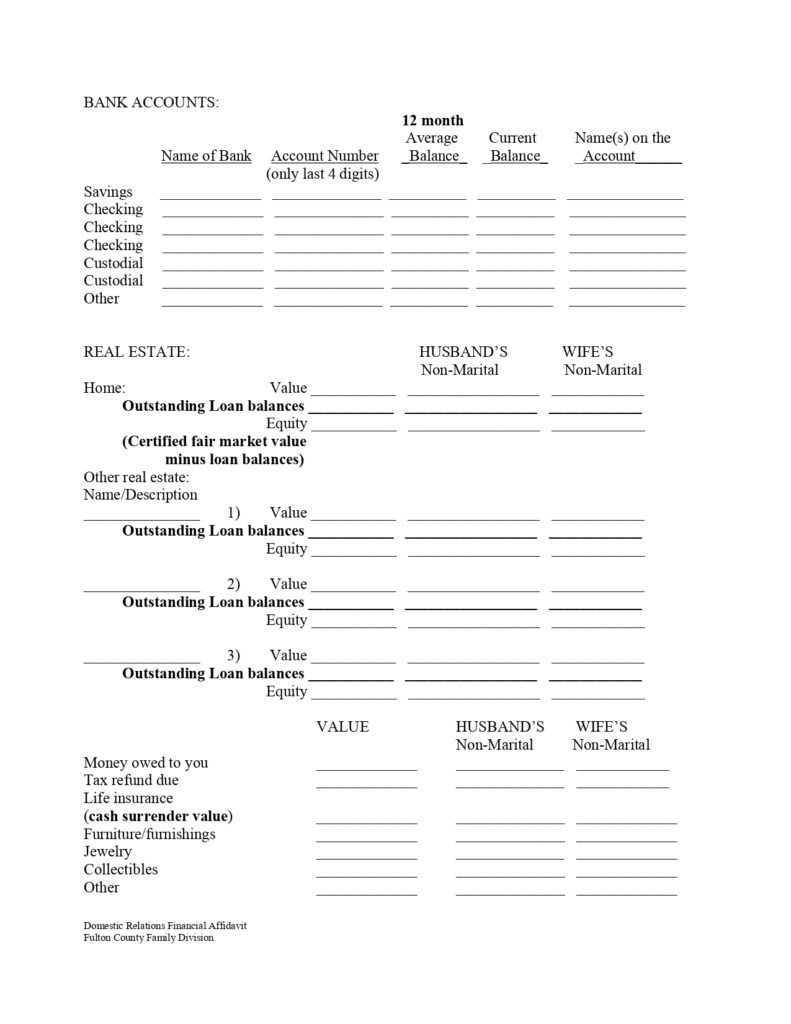

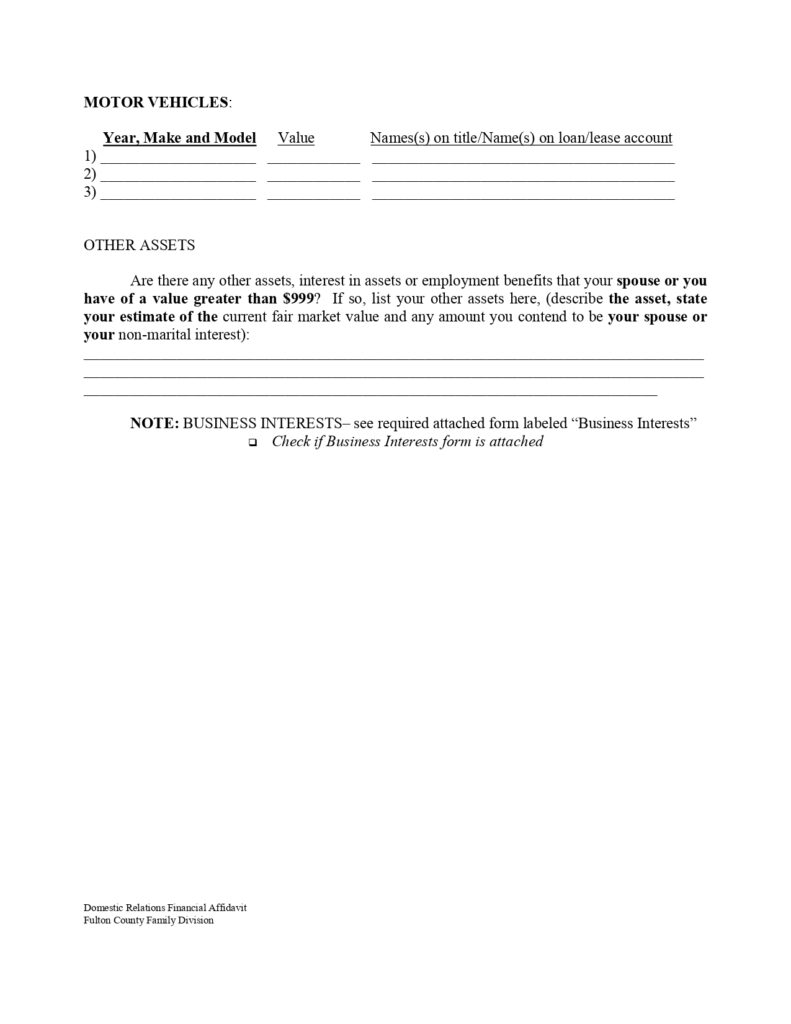

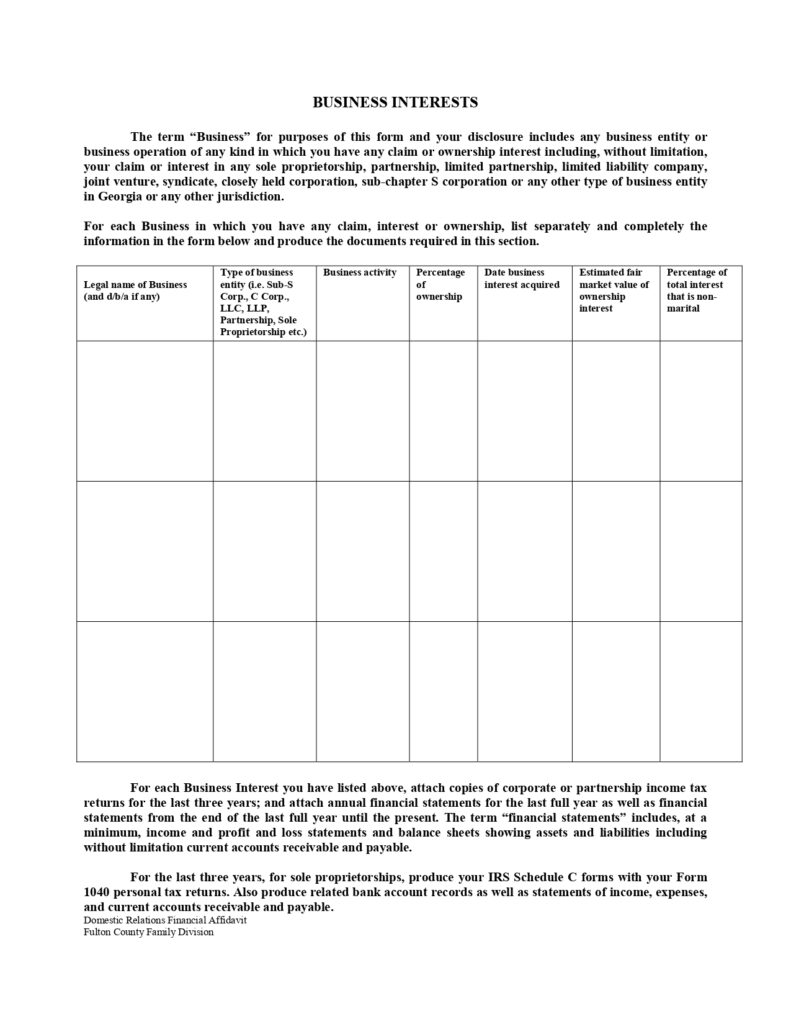

A domestic relations financial affidavit is a document that is used to provide financial information in a divorce or other family law proceeding. The affidavit is used to help the court determine how to divide the assets and debts of the parties, and to make child support and alimony determinations. The affidavit includes information about the party’s income, expenses, assets, and liabilities.

How can a financial affidavit help in divorce proceedings?

A financial affidavit or income and expense declaration is a list of a person’s income and expenses. This list is created when a person files for divorce. The purpose of a financial affidavit is to document all assets and liabilities of the individual. The information contained in a financial affidavit may be used by courts to determine what happens to a couple’s property.

You must create a financial affidavit. You may need to do this even if you are currently divorced, or if you have been separated for a while. You will need to file this document when you file for divorce. A copy of your financial affidavit must be served on the other party.

Your financial affidavit should include the following information:

Personal property

If you own any real property or personal property, you must list the value of that property and what the property is worth. Also, you must list what liens, if any, are on the property. You should be aware that certain types of debts and liabilities are exempt from being listed on your financial affidavit. For example, you cannot list on your financial affidavit taxes that were paid during the time you and your spouse were married.

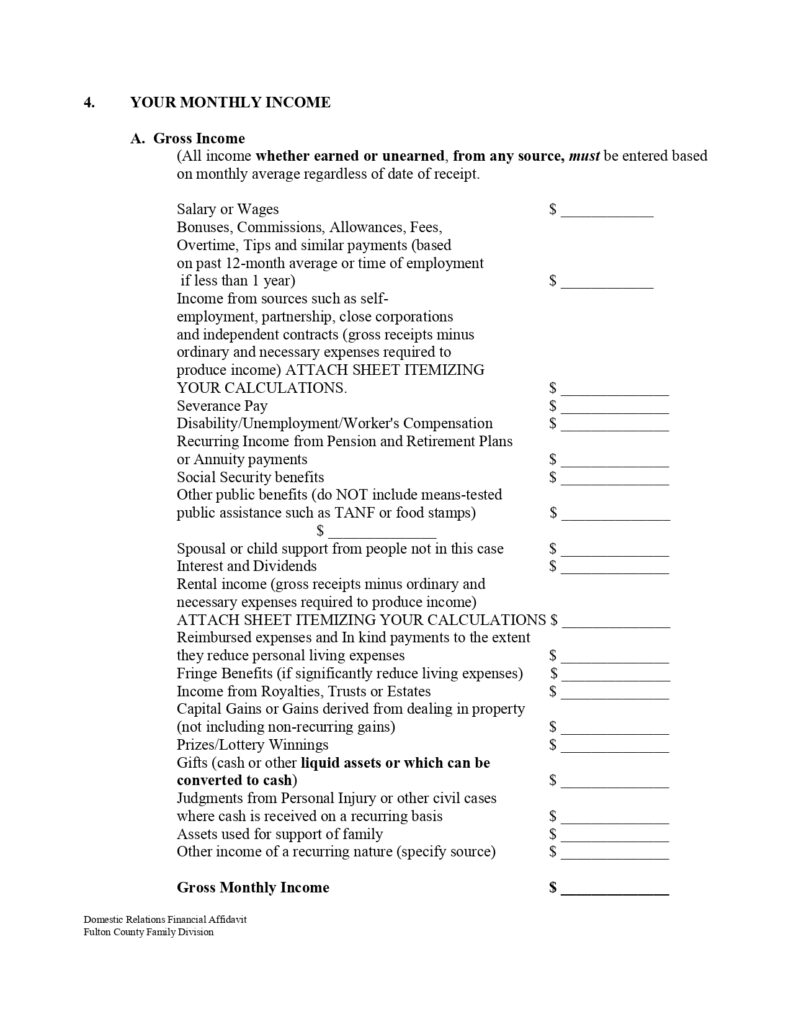

Income and expenses

You must also list your income and expenses. Income is defined as money received from a job, interest, gifts, bonuses, or other sources. Expenses are the money you spend on bills, utilities, food, clothing, rent, childcare, and other expenses. You may want to create a spreadsheet to list your expenses.

Assets

You should also list your assets and liabilities. Assets are things you own, such as your home and cars. Liabilities are the money you owe to another person or business.

Financial affidavit

The financial affidavit is a document that provides details of your financial information for the court to decide whether you are eligible for bankruptcy. This is not something that you need to fill out unless you file for bankruptcy. The financial affidavit is typically filled out by an attorney or bankruptcy trustee to provide details of your current income, assets, debts, and expenses. It can help the court to determine if you can afford a debt repayment plan and, therefore, qualify for bankruptcy.

Here’s what you need to know about filling out a financial affidavit:

You must complete it before you file for bankruptcy. You cannot complete a financial affidavit once you have filed for bankruptcy.

You must provide information about your income and expenses for the past year. You must be honest and provide accurate information.

If you owe money to someone else and are struggling to repay, you must indicate that you have tried to negotiate with the creditor. If the creditor doesn’t negotiate with you, you must state that you can’t pay the debt.

When you fill out a financial affidavit, the information you give will be used in the court’s decision on whether to grant you bankruptcy.

What information is included in a financial affidavit?

A financial affidavit is a legal document that you can use to prepare your taxes. It contains information about your assets, income, and debt. You should make this document every year if you are receiving a Form 1099 or other ongoing report from an employer in which tax deductions were made relating to salary or compensation paid.

You may also need to file an affidavit if you itemize deductions on your federal taxes, estate settlement, divorce decree, bankruptcy petition, or trust distribution statement. The most important thing to remember when preparing a financial affidavit is to be accurate and complete with all the relevant information so that there are no errors during the tax filing process.

What are the benefits of using a financial affidavit?

A financial affidavit is an important document you should file with your bank in case you file for bankruptcy. Filing for bankruptcy is a huge decision. You should seek the advice of an attorney before making this decision. However, there are many benefits to filing a financial affidavit, including:

1. A financial affidavit can protect your credit score. This document will be filed when you apply for a mortgage or car loan. Your credit score is a measure of your ability to repay debt. Banks look at your credit report to determine whether or not you’re a good risk for borrowing money. If you have a good credit score, banks are more likely to approve your application.

2. A financial affidavit can help prevent you from losing your home. This document may be required when you file for bankruptcy. Banks and mortgage lenders use your credit report to determine whether or not you qualify for a mortgage or a car loan. Your credit score determines whether or not you’ll be approved. If your credit score is low, you may be denied.

3. A financial affidavit can help protect your assets from creditors. The court may require a financial affidavit if you file for bankruptcy. In addition to being required by the court, this document can help protect your assets if you are sued.

4. A financial affidavit can help you avoid garnishment. Some states require the employer to deduct a certain percentage of your wages to pay off debt. Filing for bankruptcy may stop this practice.

5. A financial affidavit can prevent you from having to pay extra fees. You may be required to pay an attorney to file for bankruptcy. Additionally, if you want to continue making payments on your debts, you may be required to pay a fee. A financial affidavit can help prevent you from paying unnecessary fees.

Are there any risks associated with using a financial affidavit?

There are some risks associated with using a financial affidavit, but by following the instructions carefully and consulting an attorney if you have any questions or concerns, you can minimize these risks. One of the biggest dangers is signing something that you may later regret because it could affect your legal rights. Always remember to keep copies of all documents that relate to your financial affidavit for future reference.

In addition, make sure that all information in your affidavit is accurate and up-to-date so that there are no disputes down the road. Include everything from salary information to recent changes in loan repayments or credit scores. Finally, always retain a competent lawyer who will be able to help you navigate any potential problems should they arise.

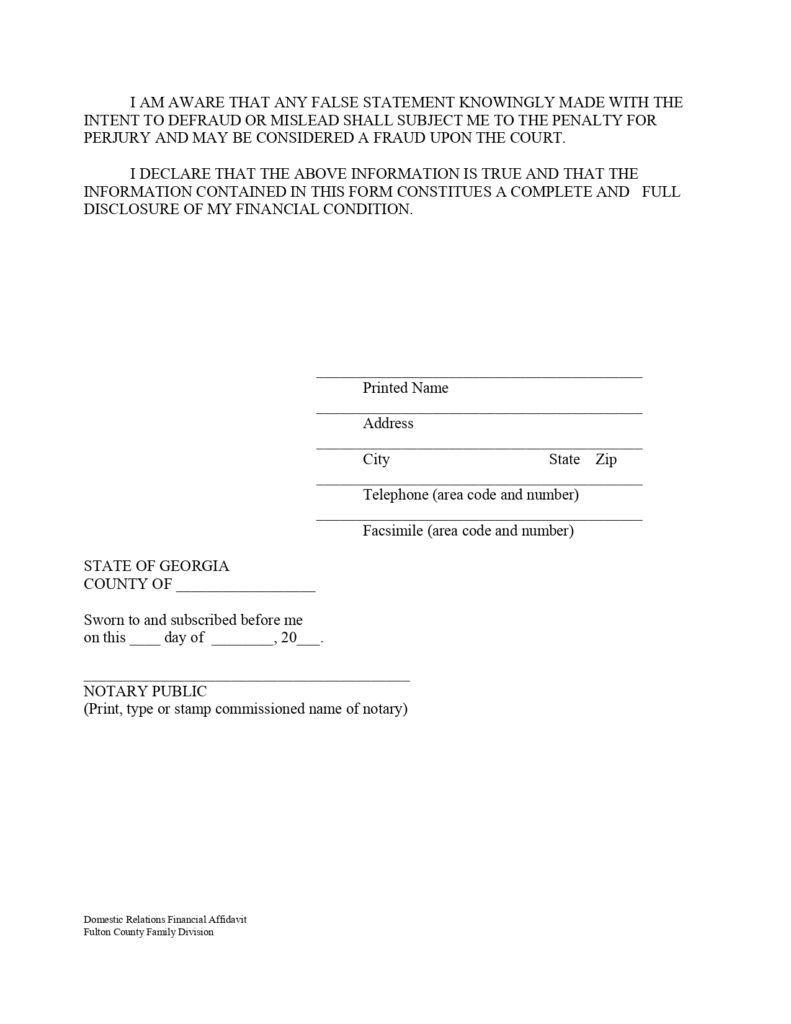

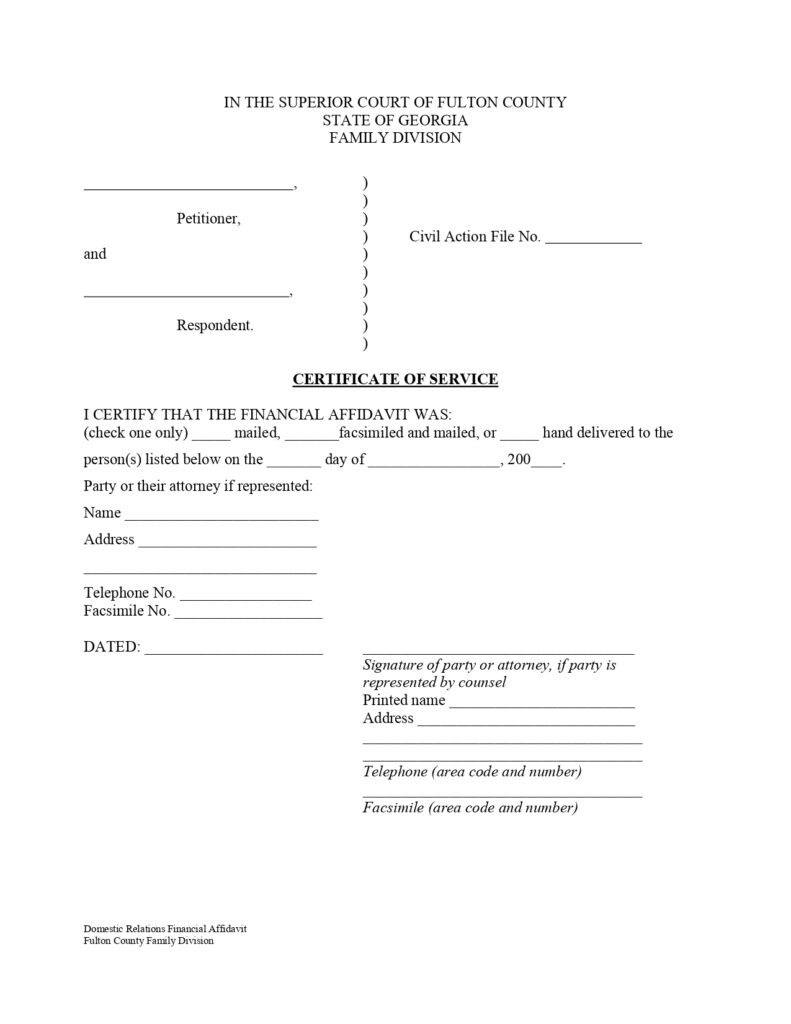

Domestic relations financial affidavit Form from Fulton County Family Division:

Concluding words

It is not surprising that many couples choose to use a domestic relations financial affidavit in their divorce case. The document makes sure both parties maintain the expenses incurred for common household expenses and maintenance of mutual properties.

In case you are planning to file a divorce, it is recommended that you complete one as soon as possible. This way, you can ensure an end to your financial troubles and not drag them on from one partner to another.

Author Profile

Latest entries

QuariesDecember 15, 2022Affidavit of non prosecution Texas

QuariesDecember 15, 2022Affidavit of non prosecution Texas QuariesDecember 4, 2022Self proving affidavit Florida

QuariesDecember 4, 2022Self proving affidavit Florida QuariesDecember 4, 2022Why Affidavit is Not Evidence?

QuariesDecember 4, 2022Why Affidavit is Not Evidence? QuariesDecember 4, 2022Heirship affidavit Alabama

QuariesDecember 4, 2022Heirship affidavit Alabama